Car repossession can significantly impact both our mode of transportation and credit scores. However, when experiencing financial difficulties, you may find yourself at risk of facing car repossession. That is why it is important to understand the loopholes surrounding car repossession. So you can avoid its negative consequences on your credit score.

This article aims to shed light on:

- The car repossession loopholes

- The effects of car repossession on your credit scores, and

- How you can recover your credit score if the car have been repossessed?

What are Car Repossession Loopholes?

Car repossession loopholes refer to legal gaps or inconsistencies in the repossession process that can use to delay or prevent the repossession of your vehicles. In addition, these loopholes allow you to protect your assets and rights when faced with financial difficulties. More importantly, it prevents negative impacts on your credit scores.

Importance of Understanding Car Repossession Loopholes

Car repossession loopholes are significant because they provide alternative options to address your (the borrower’s) financial challenges. Thus, potentially retaining your vehicles. By understanding these loopholes, you can navigate the repossession process more effectively. Moreover, it helps you assert your rights to mitigate the impact on your credit and financial stability.

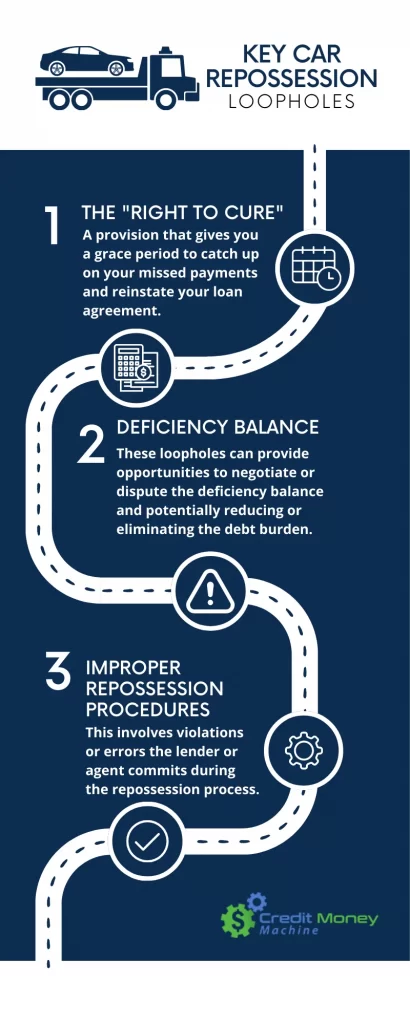

Key Loopholes in The Car Repossession Process

The "Right to Cure" Loopholes

The “Right to Cure” or the “Right to Reinstate” loophole is a provision that gives you a grace period to catch up on your missed payments and reinstate your loan agreement. Before the lender can proceed with the repossession process. Hence, you can stop repossession or get back your vehicle.

Deficiency Balance Loopholes

Deficiency balance loopholes pertain to the remaining amount you owed after the repossession and sale of the vehicle. These loopholes can provide opportunities to negotiate or dispute the deficiency balance. Then potentially reducing or eliminating the debt burden.

Improper Repossession Procedures Loopholes

Improper repossession procedure loopholes involve violations or errors the lender or agent commits during the repossession process. For example, failure to provide proper notice, unauthorized entry or repossession, or non-compliance with state-specific repossession laws. Exploiting these loopholes can lead to the repossession being deemed invalid or provide grounds for legal action against the lender.

By being aware of these key car repossession loopholes, you can protect your interests and explore potential options. To avoid or mitigate the adverse effects of repossession on your credit and financial well-being.

The Impact of Car Repossessions on Your Credit Scores

Car repossession can have a significant impact on credit scores. Most likely, it will result in negative remarks on your credit reports. These negative marks can lead to a decline in credit scores, making it more challenging to obtain credit in the future.

Repossession-related negative marks, such as “repossession” or “charge-off,” indicate to potential lenders that you failed to fulfill your financial obligations. This suggests a higher credit risk, leading to decreased credit scores.

Negative Consequences of Car Repossession on Credit History and Creditworthiness

Car repossession can have severe consequences on credit history and creditworthiness. In addition to the negative remarks, repossession can remain on a credit report for several years. Typically up to seven years. During this time, repossession can hinder your ability to secure favorable interest rates. Moreover, it can affect your ability to obtain new credit or qualify for certain rental agreements. Unfortunately, it can also affect your job opportunities which require a credit check.

Furthermore, the negative impact on creditworthiness extends beyond the repossession itself. It can result in higher insurance premiums, limited access to credit options, and difficulty obtaining loans for major purchases. Such as a house or another vehicle. For these reasons, you should utilize these car repossession loopholes. So you can delay the repossession process or even prevent it. Avoiding car repossession is preventing these consequences on your creditworthiness.

What To Do If You Miss These Car Repossession Loopholes?

If, unfortunately, car repossession happens, you’ll mostly face a negative impact on your credit scores. However, it’s important to remember that there are ways to recover and repair credit. By taking proactive steps and leveraging available resources. You can work towards rebuilding your creditworthiness and regaining control over your financial future.

Recovering and Repairing Credit After Car Repossession

Recovering and repairing credit after experiencing the negative impact of car repossession is possible. By following these steps, you can begin rebuilding your creditworthiness.

Review Credit Reports

Obtain copies of credit reports from major credit bureaus and carefully review them for any errors or inaccuracies related to the repossession. Then, dispute any incorrect information to ensure your credit reports accurately reflect your credit history.

Create a Budget and Financial Plan

Develop a realistic budget that allows for consistent payments toward existing debts and living expenses. Prioritize timely payments to demonstrate responsible financial behavior and rebuild credit over time. Tip: Using a debt acceleration app is helpful in guiding you with paying off debts fast and effectively.

Establish New Credit Accounts

Despite the challenges posed by car repossession, it’s crucial to start establishing a positive credit history. Consider opening new credit accounts. For example, secured credit cards or small installment loans. Ensure timely payments to showcase improved credit management.

Effective Credit Repair Solution After Car Repossession

When dealing with the negative consequences of car repossession, you need effective solutions to repair your credit. In such situations, credit repair software can be a valuable tool to assist in your credit recovery process. Furthermore, by leveraging the features and functionalities of credit repair software, you can navigate the complexities of credit repair with greater ease and efficiency.

The Benefits of Using Credit Repair Software

In pursuing credit repair, you can leverage the advantages of credit repair software. Such software is specifically designed to streamline and simplify the credit repair process. Here are some key benefits:

Automated Credit Dispute Process

Credit repair software can automate the generation of dispute letters. Making it easier to dispute inaccurate information related to car repossession (and others) on your credit reports. This tool streamlines the dispute process and saves time.

Educational Resources

Many credit repair software solutions offer educational resources. Plus, personalized guidance to help you better understand credit scores. As well as credit repair strategies and financial management techniques. This knowledge empowers you to make informed decisions and improve your credit effectively.

Tracking Progress and Notifications

Credit repair software provides users with real-time updates on the status of your disputes and any changes in their credit reports. Moreover, it helps you stay informed and monitor your progress toward credit repair.

Organization and Document Management

Credit repair software allows you to store and manage important documents. E.i., credit reports, correspondence, and supporting evidence, in one secure location. Thus, it ensures easy access and helps maintain an organized approach to credit repair.

By utilizing credit repair software, you can streamline the credit repair process. In addition, it maximizes efficiency and expedites your credit recovery. As a result, improve your creditworthiness.

Repair Your Credit Fast and With ease

Start building a stronger credit for you or for your clients. Start now and experience the difference for yourself!

Understanding and navigating the world of car repossession loopholes is essential, especially in preventing negative impacts on your credit scores. Car repossession can have far-reaching consequences on your credit history and creditworthiness. Thus, obtaining loans becomes difficult.